After years of declining production activity for Direct-To-Video and Made-For-TV movies industry-wide, they are making a comeback in the competitive streaming age.

Netflix is accelerating the rate it licenses and produces lower-budgeted movies for its streaming platform.

Netflix needs to expand its film library, which it has overlooked in recent years in favor of television content. This need is being exacerbated as the major studios pull their content.

MOW & DTV Resurgence

Facing the impending exodus of studio film and television content from its service, Netflix is eager to capture new subscribers with more original films. While Netflix publicly touts several big-budget original films like The Irishman and 6 Underground, there is a quiet surge for Made-For-Streaming movies.

Producers of lower-budgeted films are pitching Netflix executives daily who are predicting that the next five years will be a bonanza for these productions.

After years of declining interest in these types of films, producers and distributors at the 2019 American Film Market (AFM) are packaging these films for Netflix and several other streamers. There are several genres of films that thrive in this space, including romantic comedies, Christmas titles, true-crime stories, and science fiction.

With 155 million worldwide subscribers expected by the end of 2019, there is an abundance of substantial film niches to fill at Netflix.

This film resurgence is being fueled by the ongoing streaming wars, which are in full swing after the introduction of Disney+ last week. This battleground will only escalate as several of Netflix’s licensing agreements with Disney, Fox, NBCUniversal, and WarnerMedia expire.

Made-For-Netflix

Netflix is rushing to fill this content gap with more original content, but given the soaring production costs, the company is looking to outside producers.

The opportunities for Made-For-Streaming producers are expanding. These productions are typically much more consistent than the market for traditional independent films.

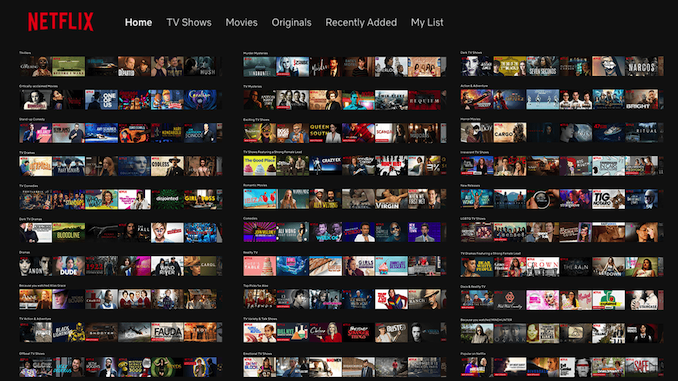

These types of films are especially appealing for Netflix, which uses in-depth algorithms to target specific segments and demographics on their service.

An example of this targeted approach is the one used by American Cinema International that produces films for Netflix, which focuses on African-Americans audiences.

There are typically two types of these films: first, the sub $2 million subset, which usually fills the slate of linear television networks such as at Lifetime, Hallmark, and Syfy channel. The second type is more in line with independent films, which are budgeted between $2 million and $10 million and have some recognizable talent behind and in front of the camera.

Within Netflix, these films are being handled by its independent film division, which is responsible for approving films with budgets under $10 million.

After the near-collapse of Megan Ellison’s Annapurna Pictures, its film president Ivana Lombardi is now heading up this division at Netflix along with Ian Bricke.

The SVOD Film Licensing Series is the Industry’s Inside Source for What Global Streaming Services Pay for Films

Accurately value film streaming revenue by combining comprehensive data from multiple SVOD licensing agreements.

Benefit from nonpublic rates to uncover what streamers pay for films.

FilmTake Away

These developments are leading to immense opportunities for low-budget film producers, which have been out of favor recently as streamers and networks alike chase the latest television series that can become global megahits.

However, this film resurgence is not without its challenges. It requires serious producers that can deliver timely and consistent content on tight budgets.

Producers that can deliver within these constraints while utilizing Netflix’s sophisticated tracking tools to develop content for specific segments of the streaming population will be in high demand.