- The Reemergence of Bundling and Partnerships

- The Power of Bundling: Apple’s Ace

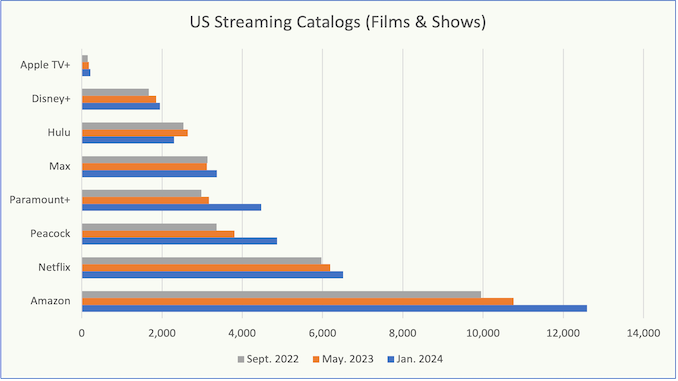

- Catalog Size of US Streamers – Sept 2022 to Jan 2024

- Worldwide Film & Television Distribution Intelligence

- Paramount’s Financial Dynamics and Investor Scrutiny

- AppleTV+ and Advertising: A New Frontier

- FilmTake Away: Apple’s Aggregation Ambitions

Apple and Paramount are on the verge of forging a bundling partnership that will include Apple TV+ and Paramount+, marking the next chapter in the streaming story.

Evolving industry developments indicate an overall trend toward strategic partnerships to compete with streaming heavyweights like Netflix and rebundling efforts between competitors that will reshape the way content is licensed and delivered.

The Reemergence of Bundling and Partnerships

Bundling streaming services marks a significant departure from the traditional model, especially as many studios have spent years re-acquiring films and shows from third-party distributors. The rumored bundle of Apple TV+ and Paramount+ exemplifies a growing trend in a profit-starved segment.

With its relatively small content library but technologically solid foundation, Apple finds a strategic advantage in aligning with Paramount’s more extensive content offerings. This partnership could redefine the competitive landscape in the streaming market and continue to shift Apple towards an aggregator.

The push towards rebundling, strategic partnerships, and diversified business models highlights the industry’s response to changing consumer demands and financial pressures.

The Power of Bundling: Apple’s Ace

AppleTV+ leverages Apple’s broader ecosystem through its bundling strategy. Despite having a much smaller content catalog than giants like Netflix or Disney+, Apple TV+ focuses on quality and integration with other Apple services.

Bundling Apple TV+ with Apple Arcade, Apple Music, and iCloud storage through the Apple One package helps Apple retain subscribers. This strategy plays a pivotal role in AppleTV+’s subscriber retention in a market where churn rates are a significant concern.

This integrated approach also positions Apple as a content provider, a comprehensive digital lifestyle brand, and, more importantly, an aggregator for multiple services that pay a hefty transaction fee to Apple for the privilege.

Despite its innovative bundling and integration, AppleTV+ faces a crucial challenge – its relatively small content library that lags in the volume-driven content race. This limited catalog could hinder its ability to attract and maintain a broader subscriber base, especially compared to content-rich platforms like Netflix and Disney+.

Catalog Size of US Streamers – Sept 2022 to Jan 2024

AppleTV+ has recently invested in live sports and high-profile projects to bolster its content offerings. These events diversify its content portfolio and offer unique viewing experiences to attract new subscribers.

Apple’s endgame is to displace Amazon to become the premier streaming aggregator as consumer demand for streamlined purchase, rental, and streaming packages continues to grow. The future of streaming success hinges on a combination of content availability, aggregation capabilities, and catering to consumer preferences in an ever-complex market.

As Apple aims to become the go-to streaming aggregator, and Paramount+ seeks to enhance its content offerings and financial stability, the industry as a whole is moving towards a more integrated and consumer-centric model.

Worldwide Film & Television Distribution Intelligence

Get unparalleled access to market intelligence reports that draw on financial data and insights from dozens of content distribution deals worldwide between key industry participants.

Film and Series distribution rates and terms deriving from dozens of agreements for rights to transmit films and episodic television via PayTV and SVOD.

Choose flexible options for single-user PDF downloads.

Licensing Terms & Included Programs:

Pay-1 & SVOD Rate Cards for Motion Pictures and Series Exhibited Worldwide in Multiple Availability Windows

- Motion Pictures: Pay-1, First Run, Second Window Features, Recent Library Features (Tiers AAA,A,B,C), Library Features (Tiers AAA,A,B,C), Current and Premium Made-For-TV Films and Direct-To-Video Films, covering many license periods over the last decade

- Episodic TV: Current, Premium, Premium Catalog (1HR & 1/2HR), Catalog Series (1HR & 1/2HR), and Catalog Miniseries + Case Studies on Current Mega Hit, Catalog Mega Hit, and Premium Catalog, covering many licensing terms from 2012-2024

- Because most-favored-nation rates operate in practice, the rates and terms apply to a diverse range of content and distributors worldwide in multiple availability windows.

Paramount’s Financial Dynamics and Investor Scrutiny

Unlike Apple, Paramount Global faces a slew of systemic challenges. With growing revenue but consistent losses in its direct-to-consumer streaming unit, Paramount+ is under heightened investor scrutiny. The reduction in the company’s dividend and the overall financial performance have raised concerns among stakeholders, including several prominent investors. Paramount’s situation reflects the broader challenges of balancing growth with profitability in the streaming industry.

Paramount Global’s potential targeting by activist investors adds another layer to its strategic considerations. The calls for revamped streaming business models, focusing on profits, and reinstating dividends echo broader concerns within the industry. Paramount’s high churn rate and content expenditure are focal points in this discussion, highlighting the complex balancing act of maintaining subscriber interest while controlling costs.

AppleTV+ and Advertising: A New Frontier

AppleTV+ is reportedly considering introducing an ad-supported tier that mirrors industry trends set by Netflix and Disney+. Advertising will undoubtedly open new revenue streams and attract a different segment of viewers. However, this shift must be navigated carefully, considering Apple’s brand positioning and user expectations around ad-free experiences.

This shift could address AppleTV+’s challenges related to its smaller content library and subscriber base. By diversifying its revenue streams and potentially attracting a wider audience, AppleTV+ might strengthen its position in the competitive streaming landscape.

FilmTake Away: Apple’s Aggregation Ambitions

Apple aims to become the premier streaming aggregator, positioning its app as a one-stop destination for various streaming services and paid entertainment options. This ambitious plan seeks to capitalize on consumer demand for streamlined, centralized access to content. Achieving this would place AppleTV+ in a league alongside Amazon, distinct from other leading content-driven platforms, like Netflix, Disney+, and Max.

As AppleTV+ continues to evolve, its success will hinge on a balance between innovative bundling, compelling content, and strategic market positioning. While its approach sets it apart from competitors, the challenge lies in enhancing its content catalog.