The box office in North America was down almost 5% from 2018 even after rising ticket prices, and despite a slew of mega-budget franchise films being released.

Ticket revenues reached $11.4 billion in North America off its all-time high of $11.9 billion last year.

However, worldwide ticket sales surpassed $41 billion; the international total of $30 billion is a new record.

Sales Down, Prices Up

In 2019, there were 1.22 billion movie tickets sold in the United States, which was off from 2018 when 1.31 billion sold. Last year was a 25-year low in terms of movie tickets sold in North America, and the proportion of the population that went to at least one movie dropped again. The high-water mark for ticket sales was 1.57 billion in 2002.

Box office revenues have climbed 23% since 2002, but only because of soaring ticket prices, especially in major markets like New York and Los Angeles. In the last ten years, ticket prices have risen to 25%, and although the average is around $9.50, in most major markets, ticket prices surpass $14.

Rated-R Revival

For the first time in two decades that there were five Rated-R films in the top twenty films, including Joker, which became the highest-grossing Rated-R film in history.

READ MORE: The Department of Justice in the United States is preparing to allow the Hollywood studios to own film theaters once again.

Disney Dominates Domestic

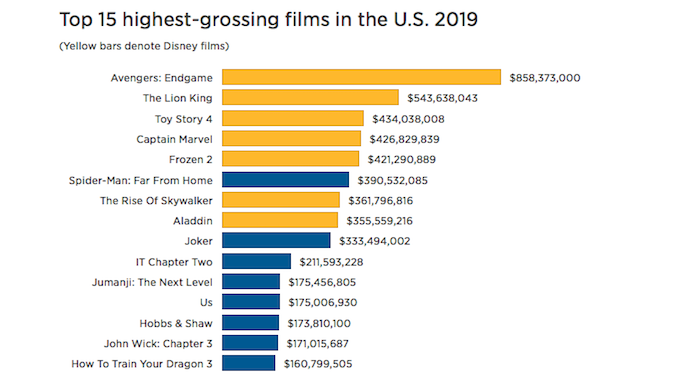

Unsurprisingly, Disney-produced films accounted for a third of the total box office in North America last year. When counting Fox’s releases, which Disney now owns, Disney’s share rose to 40%.

Warner Bros. came in a distant second with around 14% of the box office share, followed by Universal with 13%, and Sony with 12%. Paramount Studios fell even further after years of mismanagement with only 5% of the box office share based on 11 releases, none of which surpassed $100 million in receipts.

Disney’s share of the market will only expand with the greater incorporation of Fox Studios. Fox had an off-year in 2019 because of the ownership change, management attrition, and the poor performance of its final X-Men film, which bombed at the box office.

Disney competed evenly at the box office with the other major studios a decade ago but has since left all others in their dust. Strategic acquisitions of Pixar (2006), Marvel (2009), and Lucasfilm (2012) propelled Disney into another stratosphere.

As Paramount and Sony fall even further, expect 80% of the theatrical market to be dominated by only three studios – Disney, Universal, and Warner Bros.

Franchises and Sequels and Remakes, Oh My!

Six films released by Disney each managed to gross over $1 billion worldwide, including Toy Story 4, Frozen 2, and the live-action The Lion King. Avengers: Endgame became the highest-grossing film in history surpassing the 2009 release of Avatar.

In North America, Disney films grossed a record $3.72 billion last year topping its own record from 2018 of $3.09 billion. Disney’s box office revenue in 2019 was a record for any studio in history. Globally, Disney films grossed $11.12 billion in 2019; $2.8 billion alone came from Avengers: Endgame.

Spider-Man: Far From Home was the only non-Disney film to break the top eight grossing films, but even that film was co-produced by Disney’s Marvel Studios along with Sony.

However, Disney’s, and for that matter, Fox’s slate in 2020, is notably weak. For the first time since 2015, Disney will not have a Star Wars film to release in 2020. The studio will only release one Marvel film, Black Widow, and both of its Pixar films are new properties.

The top 10 films in North America accounted for 40% of box office receipts, compared to 32% for the three years prior.

FilmTake Away

As more audiences opt for the comfort of their home to watch an ever-expanding array of films and shows from streaming services, theatrical admissions will continue to decline.

The exhibitor’s strategy of providing better concessions and more luxurious seating might be too little too late to lure crowds back, especially as phone usage and talking during screenings is commonplace.

Based on these trends and weak film slates from most major studios, 2020 should be another down year at the box office in North America.