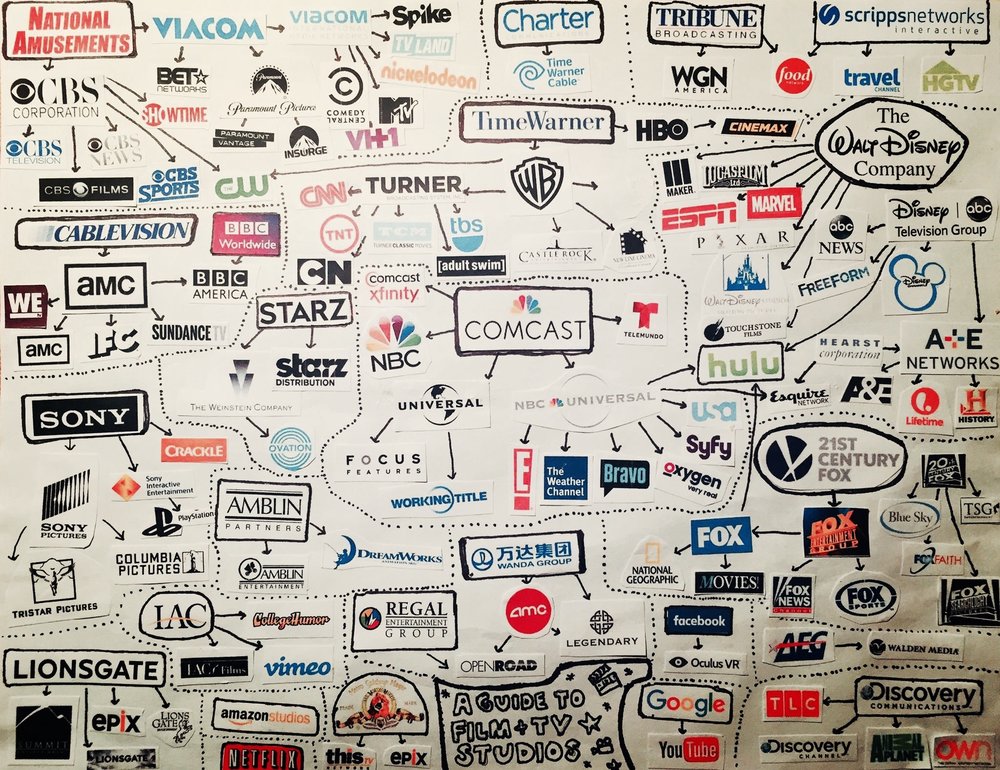

Television networks, telecoms, technology companies, OTT services and film studios are competing against each other like never before in order to deliver diverse content directly-to-consumers.

State of the US Industry

As 5G services rollout in the United States, telecom companies are jockeying to be in the driver’s seat. Consumers no longer care if their content is delivered wired, wireless, through cable or satellite.

Multiple system operators (MSO), such as cable, satellite, and television companies are launching or acquiring wireless units. Meanwhile, telecoms are buying satellite and MSOs.

This consolidation is illustrated in the AT&T and Time Warner deal; approval of which is coming soon. And Disney’s proposed buyout of Fox, in which Comcast is prepared to outbid Disney.

Blurred Lines

Technology companies are morphing into content creators, distributors and sales agencies are venturing into production finance, and studios are attempting to launch stand-alone streaming services.

This divergent environment is creating enormous opportunities for producers, distributors and creators of content to exploit emerging niches and rediscover forgotten segments of the market by focusing on the end-user.

TV and Video Exodus

In 2015, nearly 80% of US households subscribed to cable, satellite, or a telecom service for media and entertainment. By next year, the percentage will likely fall to 71%

Likewise, the global television and home video market peaked at $110 billion in 2015; revenue will likely shrink to $100 billion by the end of the year. This market includes PayTV subscriptions, DVD/BD sales and rentals and VOD.

For three straight years, television and home video markets in the United States have lost subscribers. This downward trend is accelerating and shows no signs of abating.

The obviously winners in the exodus from traditional viewing platforms are Netflix, Amazon, YouTube and to a lesser extent Hulu.

Digital revenue accounts for 51% of all media and entertainment spend.

The SVOD Film Licensing Series is the Industry’s Inside Source for What Global Streaming Services Pay for Films